According to the Intergovernmental Panel on Climate Change’s Sixth Assessment Report, climate finance and technological innovation can be critical enablers for accelerated climate action when applied to measures to both mitigate greenhouse gas emissions and adapt to climate change impacts.

However, an analysis of the projects piloting early-stage climate adaptation and mitigation innovations under the FCDO-funded Frontier Technology programme, implemented by DT Global, evidenced that, whilst there is an assumption that there are opportunities to unlock scaling pathways through tapping into existing sources of climate finance, a large proportion of the existing funds are directed towards climate technologies already operating at scale. As a result, many of the pilots the Frontier Tech Hub has supported have experienced difficulties navigating the climate finance landscape.

To help overcome the challenges of accessing climate finance for early-stage innovation, DT Global collaborated with Urban Emerge to develop a landscape review to explore the role that public sector grant funding can play in unlocking private sector climate finance investment in early-stage innovation. The study was informed by a combination of comprehensive desk-based research and semi-structured interviews with key stakeholders and validated through three workshops.

Climate finance, defined by the UNFCCC as “local, national or transnational financing – drawn from public, private and alternative sources of financing – that seeks to support mitigation and adaptation actions that will address climate change”, is not always clearly demarcated.

Early-stage mitigation and adaptation solutions in low- and middle-income countries play an important role in developing climate response mechanisms but are often held back from attracting conventional finance to scale for a range of reasons including high upfront costs, unproven business models, longer time frames to achieve impact and return on investment, and a lack of climate-impact data. Traditionally, available funding has concentrated on innovation providing mitigation solutions, as opposed to adaptation measures that are seen as more likely to generate revenue through sales of a particular service. Climate finance, therefore, can play a role in supporting early-stage innovation to overcomes these barriers to achieve scale.

However, with an estimated US$ 4.5-5 trillion investment in clean energy, energy efficiency, and other low-carbon technologies need annually to transition to a sustainable, net-zero emissions, resilient and green future, mobilising the necessary finance to support this transition is a major challenge requiring a drastic increase in private sector investment to close the financing gap, particularly in low- and middle-income countries where the gap is largest.

This review identified four broad categories of climate finance that can be deployed or accessed to support early-stage innovation to achieve scale:

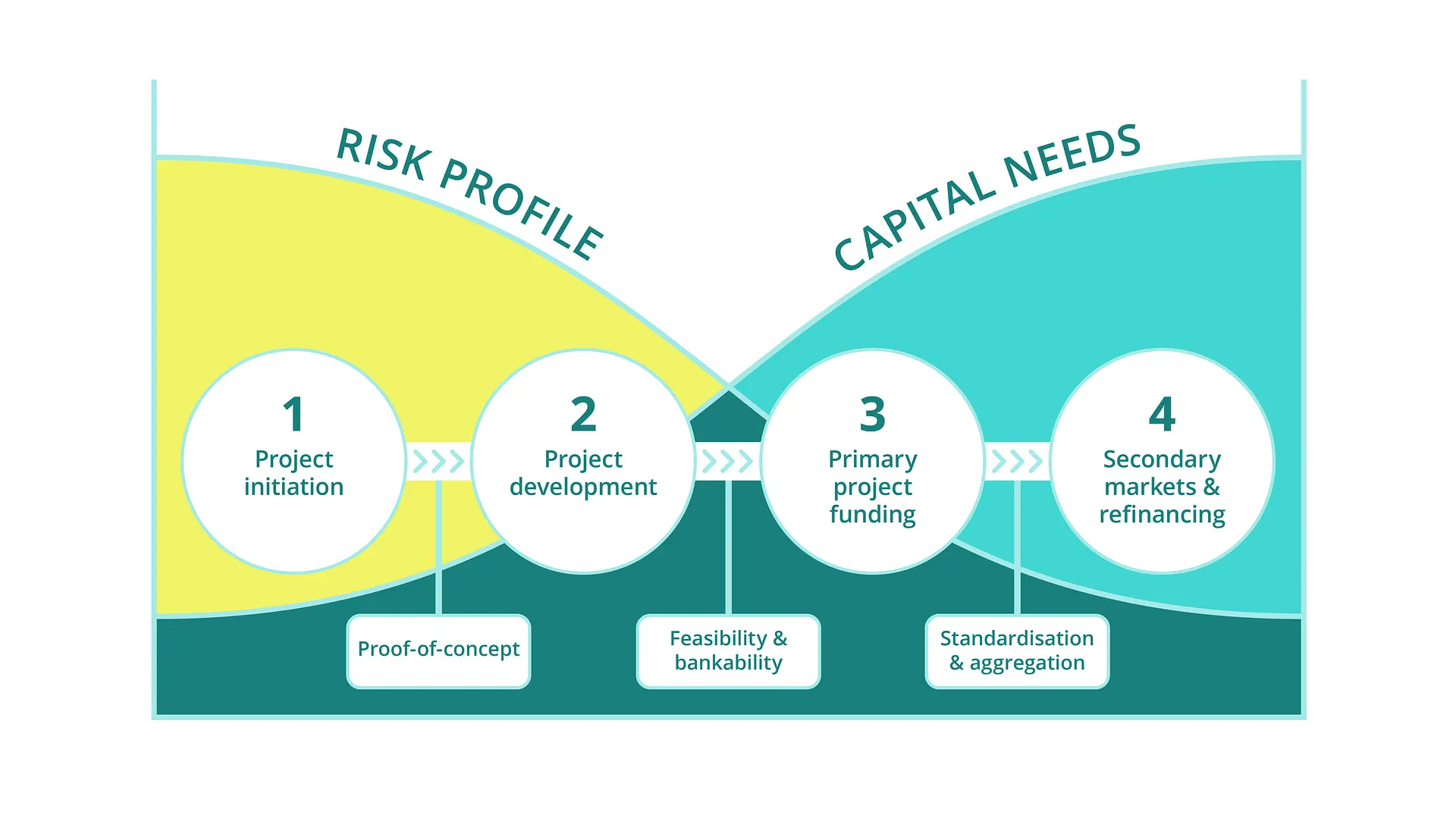

Early-stage innovations require different types and volumes of finance at different stages of their journey to scale. To conceptualise this, the review draws on the UK government-funded Climate Finance Accelerator’s ‘climate finance investment chain’ framework. According to the framework, most projects, pilots, or start-ups go through a four-stage cycle: i) project initiation, ii) project development, iii) primary project funding, and iv) secondary markets and refinancing. During this cycle, the inherent risks in projects and businesses typically decline over time, while their capital needs generally increase.

Typically, pure grant finance is applied during the earlier initiation and development of a concept or initiative, as seed funding or to enable the development of a concept, feasibility and/or business model. Whereas public sector, philanthropic, and private sector capital can be applied as catalytic capital during the middle stages of the investment chain, to help leverage private sector investment, as part of the preparation for primary project funding. Blended finance, facilitated by public sector catalytic finance, would be applied at the later stages in the investment chain, once the risk profile improves, and the significant resources required for a blended finance vehicle are more likely to generate a return on investment as a result of commercial success. Carbon markets can be accessed by start-ups or pilots later in the investment chain once they have become more established and have generated sufficient evidence of their impact.

For start-ups and pilots at the project initiation stage, project development and primary project funding stage (stages 1, 2 & 3) of the investment chain:

For start-ups and pilots at the secondary markets and refinancing stage (4) of the investment chain:

The full report is available online at the Frontier Tech Hub website.